Inflation is at its highest level in 40 years and has pushed up the prices of most consumer goods and services, including housing, transportation and food.

Americans are spending more on everyday essentials, forcing many to reevaluate priorities and make adjustments such as cutting back on dining out, opting to brew coffee at home vs. visiting a favorite coffee shop, spending less on nonessentials and switching to more affordable products to cut costs.

Given all of these shifting behaviors, it is more important than ever for businesses to use location intelligence to monitor behavioral trends and inform decision-making.

In this report, we take a closer look at how inflation has impacted consumer behavior, analyzing visitation to places like fast food restaurants, coffee shops and various retail stores over the past year.

Here are three key ways in which businesses are leveraging these insights to drive better business outcomes:

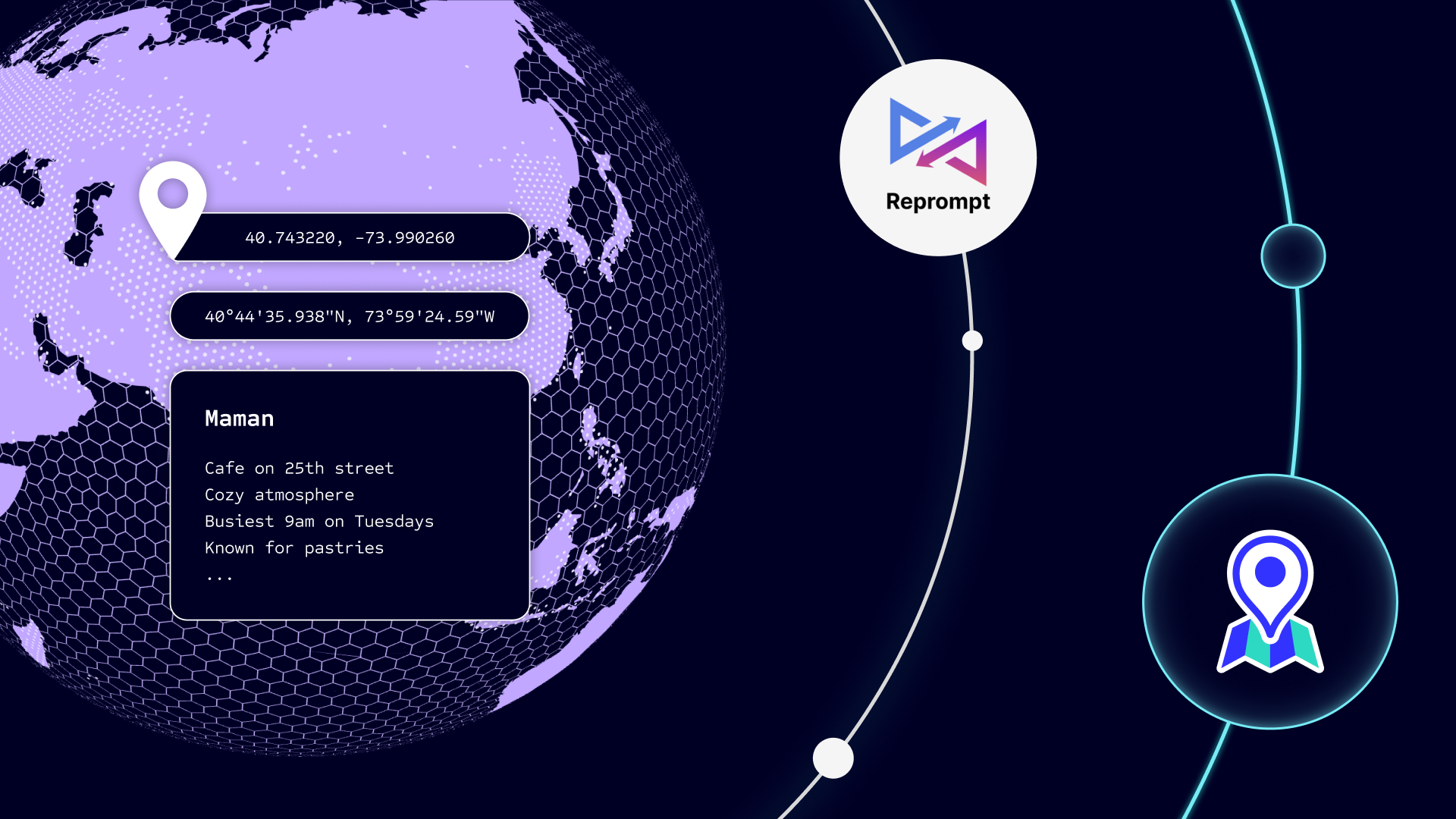

1. Planning inventory and demand with location intelligence

Companies can no longer forecast demand and optimize their supply chains based on historical sales, as consumer behavior is changing rapidly and in unpredictable ways. For example, Foursquare data shows that while traffic to wholesale retailers like Costco and Sam’s Club is on the rise amidst inflation (up +7% year over year), discount stores like Dollar General are not seeing similar upticks (remaining fairly stable year over year. By incorporating foot traffic data into their models, businesses can more accurately identify and capitalize on trends, improving efficiency of their models and reducing waste.

2. Deriving competitive intelligence using foot traffic signals

Businesses are utilizing location data to contextualize their performance relative to the competition, analyzing store traffic to various chains by market. For example, our data shows that quick service restaurants overall are seeing an uptick in traffic year over year, winning share from upscale restaurants as consumers look for more affordable dining options. However, certain QSR chains are benefitting from this trend more than others. For instance, Jimmy John’s and Taco Bell are both seeing significant upticks year over year.

Location data can also shed light on why certain businesses are declining and surging in popularity amidst inflation, revealing behavioral nuances by audience. Our research indicates that Generation Z is driving the most substantial growth in foot traffic to QSRs, corroborating studies showing that Gen Z has been hit particularly hard by inflation.

3. Analyzing location data to inform quantitative investment strategies

While the stock market is down significantly year over year, store traffic to nonessential retailers like apparel, department, furniture and electronics stores are only down 5-10% year over year. If consumer behavior follows the stock market, this means store traffic will continue to decline in the coming months. Quantitative investors are leveraging alternative datasets like location to guide their strategies. Foot traffic can serve as a powerful signal of which publicly traded companies are declining or surging in popularity. By inputting visitation data into their models, investors can forecast trends sooner and outperform the market.

Interested in learning more? Download the full report here.