See this week’s top 15, plus industry trends and takeaways

As the COVID-19 pandemic continues to unfold, we’re sharing how the virus is impacting foot traffic to a variety of places across the United States (past editions here). With the world starting to open back up, we’re seeing pent-up demand to engage in the physical world. Where will people go first? One area where we’re seeing a significant uptick in foot traffic is to casual dining restaurants, now that dine-in service is being reintroduced in many states. We decided to dig into our data to better understand which casual dining restaurants are on the fastest road to recovery.

This week, we’re launching The Casual Dining Recovery Ranking, an assessment of the top CDR chains in the United States ranked according to who we expect to recover first post-pandemic.

How does Foursquare anticipate recovery?

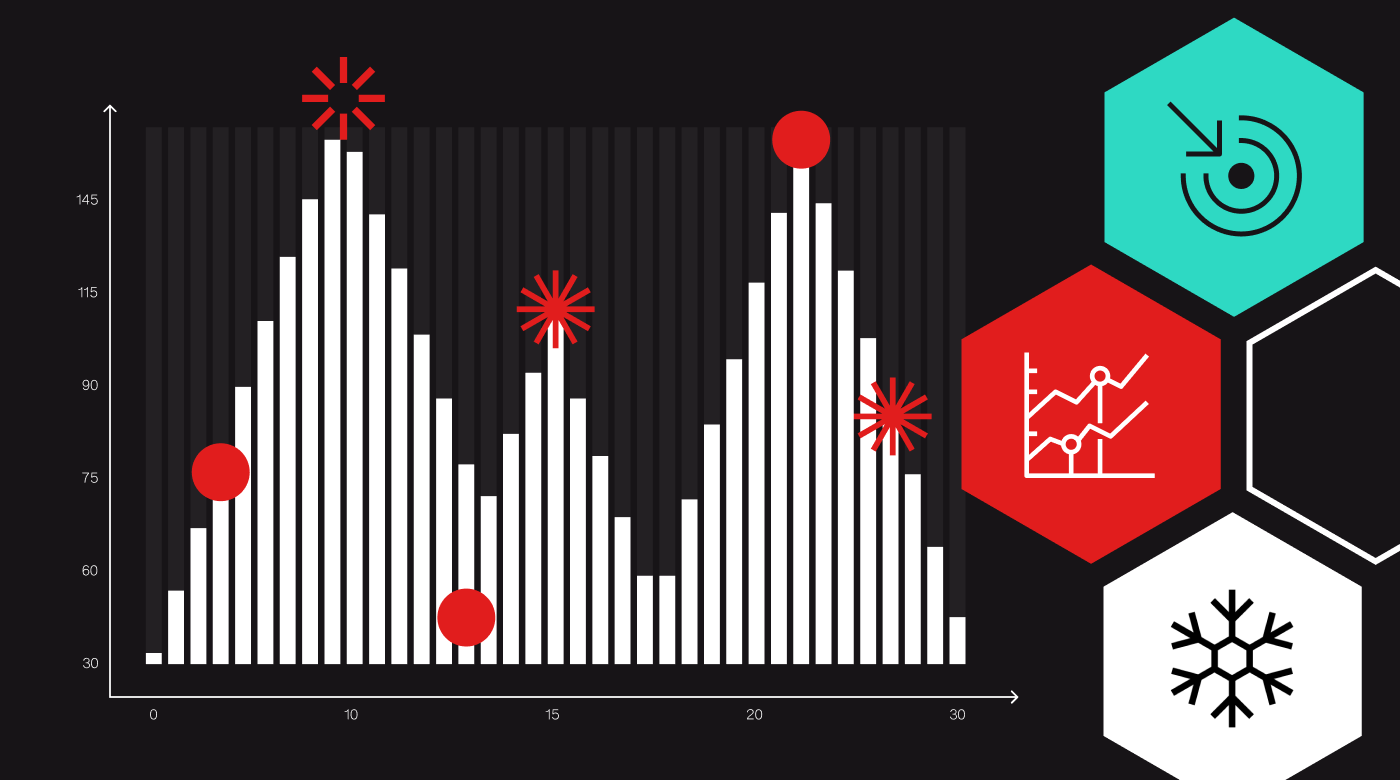

In order to determine which chains may recover first, we’ve analyzed foot traffic to casual dining restaurants across the U.S., using two key dimensions:

- Relative Decline, indicating how far a casual dining restaurant fell, in terms of the relative drop in foot traffic during the height of the pandemic. For example, LongHorn Steakhouse saw an 80% decline in visits as compared to a pre-COVID-19 baseline period, whereas Denny’s greatest decline during the pandemic was only 64%.

- Rate of Recovery, based on the slope of foot traffic to a chain increasing since ‘bottoming out.’ For example, Red Lobster’s foot traffic is actually increasing at a faster rate than Chili’s Grill & Bar, despite falling lower than these chains in the overall rankings.

Foursquare’s Recovery Ranking distills both dimensions into a single metric that can be compared across chains nationwide. For this analysis, Foursquare examined foot traffic to the casual dining chains in National Restaurant News’ Top 500 Chains. To further isolate the COVID-related impact and recovery trends behind this ranking, foot traffic was seasonally adjusted according to natural visit patterns observed last year.

Who tops the list?

It likely comes as no surprise that some of the country’s leading national chains like Applebee’s and Chili’s Grill & Bar top the list of casual dining restaurants with the highest rate of recovery. These restaurants offer a pleasant atmosphere, nationwide presence, and dependable food quality and service. However, our data also shows smaller regional chains and niche players making inroads.

While upticks in foot traffic to casual dining restaurants may stem from dine-in service being reintroduced in certain states, many of these chains have offered curbside pickup throughout the pandemic – some with more success than others. Thus, our analysis includes both dine-in and takeout visits.

Top Trends:

- Regionality influences speed to recovery. While some of the country’s biggest national brands have claimed the top spots, size is not necessarily an indicator of success when it comes to recovery. Regional brand Waffle House topped the rankings, ahead of much larger national competitors. Restaurants with a high density of locations in the South and Midwest may recover sooner, as we’ve seen the largest upticks in foot traffic to casual dining restaurants in these regions.

- Rural restaurants will likely recover first. Casual dining restaurants that are popular in rural areas, such as Cracker Barrel, Red Lobster and Applebee’s, are favored to win the race to recovery, as we’ve seen the largest upticks in casual dining visits in less densely populated areas.

- Men are driving restaurant recovery more than women, and casual dining chains with a strong male customer base pre-pandemic may be better positioned to succeed. For example, Hooters saw 62% of visits from men pre-pandemic (September 2019-January 2020) and topped the rankings at #2 this week. Waffle House, who topped the rankings this week, saw 58% of visits from men pre-COVID-19. Meanwhile chains that rely more on women, such as Olive Garden (with 54% of visits from women pre-pandemic), may be slightly slower to recover.

- Happy hour could be key to recovery. Analyzing casual dining recovery by daypart, we see that foot traffic has picked back up relatively most in the afternoon between 2-5PM. Some of the casual dining chains we expect to recover most quickly offer afternoon specials during these times – for example, Hooters, Applebee’s and Red Lobster all offer 3-6PM weekday specials.

The Takeaway

The casual dining chains that will recover first depends on both the relative decline at the height of the pandemic and the rate of recovery. A restaurant that was hit harder by the pandemic may actually recover sooner than a chain that was less impacted, given a faster rate of recovery. A restaurant with smaller declines in foot traffic during the height of COVID-19 may actually be slower to reach pre-pandemic levels, given a slower rate of recovery.

Foursquare’s Recovery Ranking distills these complexities into a single ranking for brands across the dining industry, informing:

– Loyalty and rewards programs – Identify your core audience from pre-COVID-19, letting them know you’re open for business and can deliver the cuisine they’ve been craving.

– Tailored messaging – Adjust creative and KPIs based on consumers’ changing preferences, encouraging takeout and delivery amongst those less likely to dine-in again, while driving visits amongst those who are eager to dine out.

– Competitive conquesting – Reach consumers who were loyal to a competitive casual dining chain before the pandemic, influencing their behavior as the muscle memory of consumption is being reset.

– Re-opening operations – Decide how to scale operations, planning inventory, staffing, and supplies based on when we can expect foot traffic to reach roughly pre-pandemic levels.

Looking to Learn More?

Reach out to us via the Contact form below for a full Casual Dining Road to Recovery POV, including the most recent rankings of top national chains, changes in the rankings week over week, details about specific restaurants’ relative decline and rate of recovery, and tailored strategies to help your brand to boost your rate of recovery. For updates on nationwide and regional trends across verticals shared in past weeks, please visit Foursquare on the Amazon Data Exchange.

Editor’s Note: Foursquare analyzes foot traffic patterns from more than 13 million Americans that make up our always-on panel. All data is either anonymized, pseudonymized or aggregated, and is normalized against U.S. Census data to remove age, gender and geographical bias.