Consumer-facing industries such as retail and quick service restaurant (QSR) have long seen the value of foot traffic data in its ability to approximate sales performance and foreshadow consumer trends. Beyond providing market-level insights, however, foot traffic data can also inform marketing efforts like online-to-offline campaign measurement. Doing so requires a trustworthy location intelligence partner, but not all platforms are created equal, with visit data being the most challenging to get right. Because it marries both data and nuanced technology to determine whether someone has truly stopped at a particular location, data quality can be mixed among providers. But how can marketers differentiate one partner from another? It’s all about knowing what to pay attention to.

In Part One of our series on “The Dilemmas of Location Data,” we evaluated why data sourced from a software development kit (SDK) is better than spotty foot traffic insights from the bidstream. In Part Two, we compared venue mapping techniques, and why Foursquare’s multi-sensor approach is best-in-class.

Now, let’s conclude the series by conducting a review of stop detection technologies and by explaining how our use of rate of movement differentiates Foursquare’s visit attribution methodology from the pack.

Stop in the Name of Visit Accuracy

A partner’s data source can reveal two things about their stop detection models: the frequency by which signals are “seen” by a platform and whether a technology measures rate of movement. Let’s do a deep dive on each topic.

Signal Frequency

As we reviewed in the first blog post, data sourced from the bidstream is incredibly sporadic because location signals only include latitude and longitude coordinates and the timestamp around when an ad is delivered. These once-a-month signals only see a portion of consumers’ movement. Additionally, they have no way to confirm when that individual has arrived at a location, the time they spent in the same place, or when they made an exit.

Ad SDKs, while slightly better, also lack the ability to persistently track users’ movement, relying only on once-a-hour location signals. The frequency of location signals generated by SDKs can also vary based on what location sharing permissions are configured on a user’s smartphone. Foreground sharing permissions, for instance, only track location when an app is open and active on a device. All of this showcases why SDK-derived location signals may be incomplete or fail to serve as a true indicator of real visits.

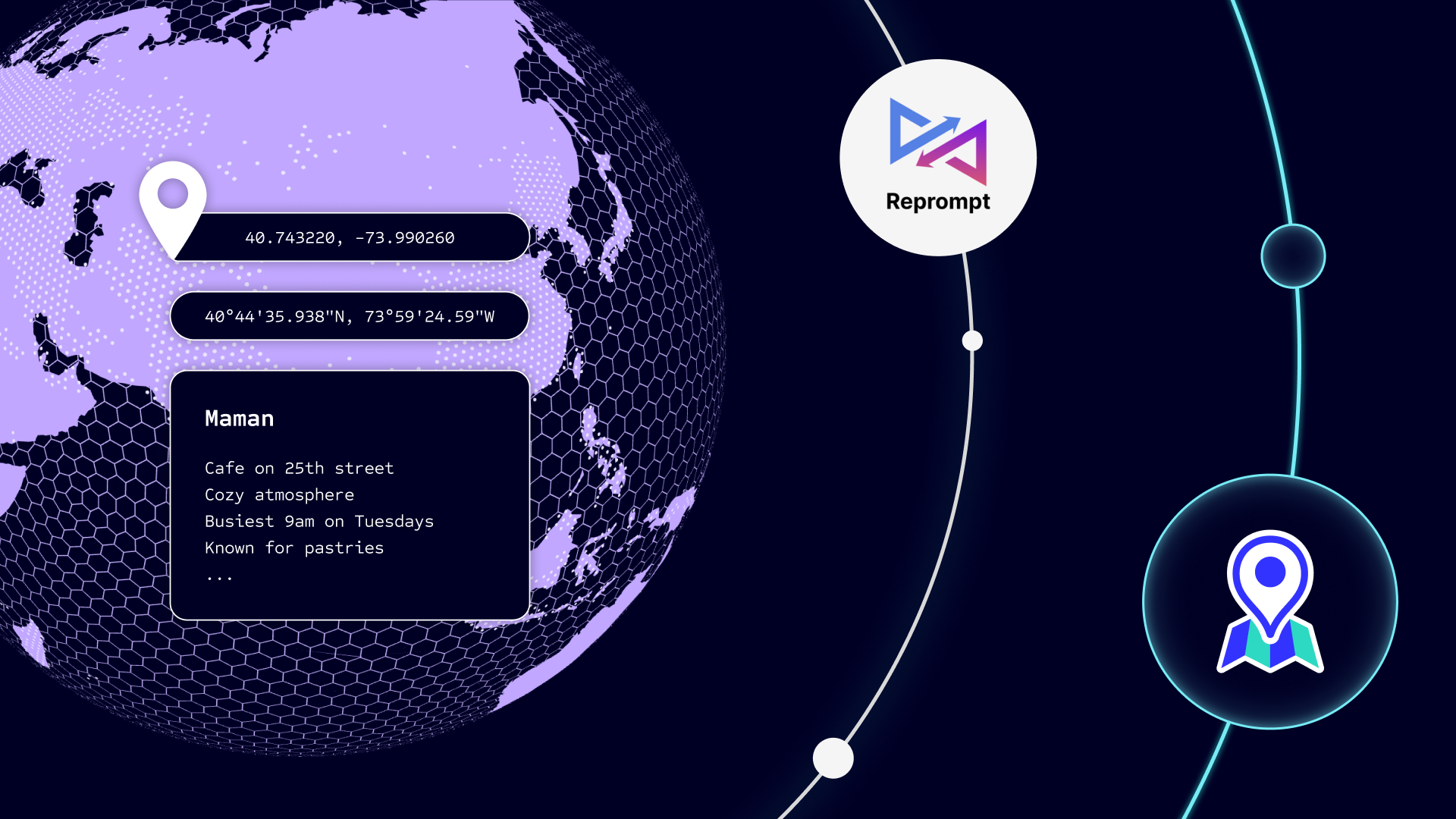

Unlike data from ad SDKs, data collected from Pilgrim SDK—our persistent location awareness technology— comes from partners whose users have elected to enable “always-on” background sharing on their devices. The ability to track real visits by utilizing a multitude of signals, including Bluetooth beacons, GPS distortion measurement, WiFi triangulation, and time of day popularity ratios, also differentiates our SDK from competitor platforms focused on location. As a result, our online-to-offline measurement solution—Attribution—leads the industry in accuracy. Totaling 13 million users (and growing), Foursquare has the largest “always-on” panel in-market. What’s more, we only partner with companies that prioritize consumer-utility in their apps, capturing informed consent from their users. The result is better and more holistic visit detection, made more precise due to the frequency of location signals seen by our platform.

Rate of Movement

In the context of location, rate of movement or velocity looks at users’ visitation trails over time. If for example, only time spent at a location was used to measure stops, then an individual stuck in a traffic jam would be determined to have “visited” during this time. A cluster of location signals at a specific area over a period of time increases the confidence that a visit has taken place. Our stop detection model considers rate of movement to surface visitation patterns, an approach that is unique to us and our persistent location awareness technology.

As you can see, not all location data partners apply this same level of sophistication to their approaches, limiting their ability to deliver stop detection results accurately. Downstream, this impacts a marketer’s ability to accurately assess online-to-offline visitation patterns with Attribution or market-level foot traffic trends with Analytics.

Key Takeaways

The ability to measure an actual visit, with precision, is driven by accurate stop detection technology, fresh venues data, and quality first-party data sources. This is not a given among location intelligence platforms, however. Only Foursquare combines our crowdsourced venues database of 105 million points-of-interest and superior stop detection methodology to generate robust visit data. The result is industry-leading foot traffic analytic solutions and offline measurement tools to optimize your media mix.