Whether expanding into new regions, optimizing supply and delivery chains, or segmenting and serving customers by geography, many different types of businesses are routinely making location-based decisions. To support these actions, companies often turn to data analysts and data scientists who can work with large-scale geospatial datasets. These experts are rare, and commonly lack the tools they need to extract patterns and relationships from geospatial datasets at scale. As a result, most enterprises today under-utilize geospatial data. In fact, Forrester Research reports that 73% of data strategy leaders agree that harnessing location intelligence across an organization is critical to driving business results, while only 26% of those same leaders say that their organization is utilizing location intelligence to its full potential.

So who is in this minority of individuals that are extracting value from geospatial technology?

A likely candidate – financial services firms.

If you’re in an industry outside financial services, don’t fret – location intelligence is still valuable for your day-to-day investment decisions. Here are some key lessons you can learn:

Make informed investment decisions from market trends and foot traffic data

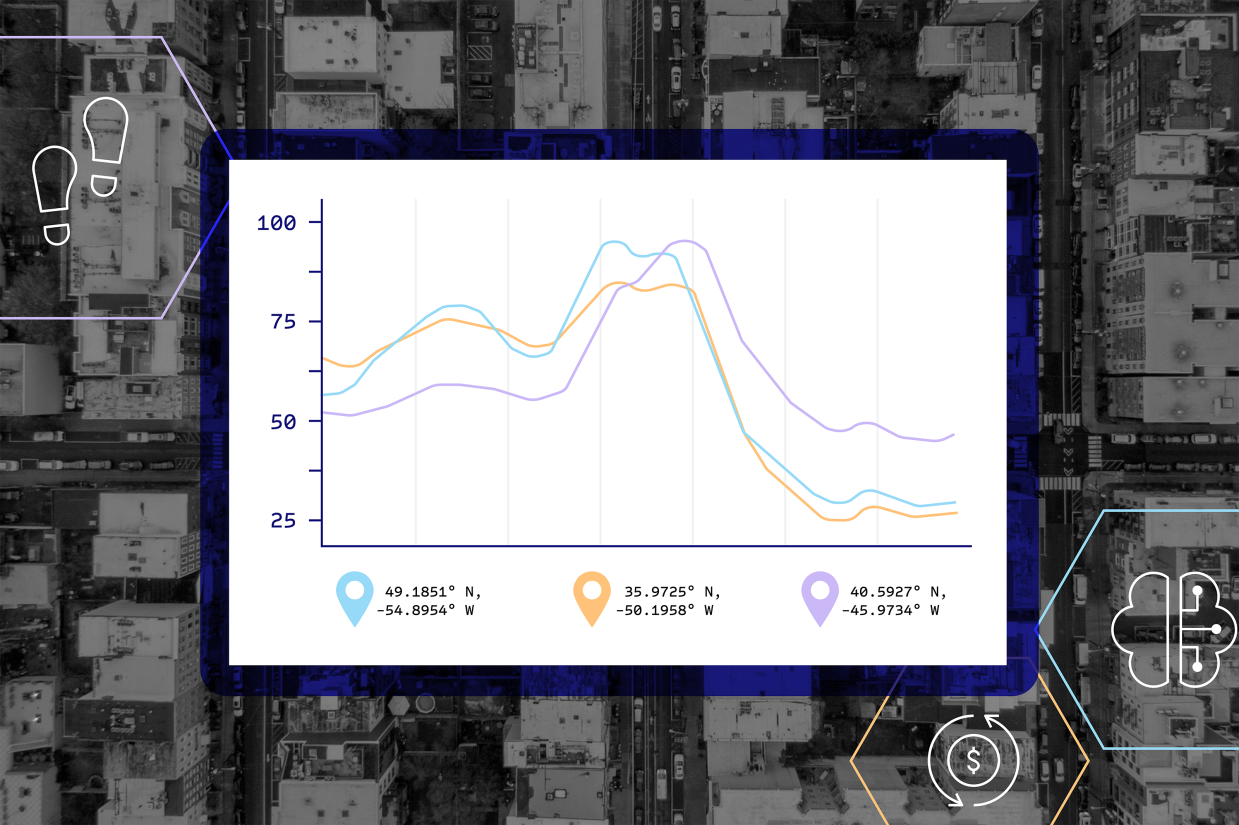

Finance professionals use location intelligence to limit risks and make more accurate predictions about which industries or brands are smart investments. Using location intelligence to strengthen predictive capabilities is of the utmost importance to financial services firms. With this prominent use case of informed decision-making around different types of investments, a technique often implemented is using geolocation data to measure visitors of a given location as a proxy for how a business is performing across a franchise and in relation to competitors.

A 451 Research report indicates that the the top three use cases for businesses when working with location intelligence include: investment opportunities based on market trends (eg. identifying up and coming neighborhoods) and trade area analysis (eg. mapping the trade activity within a specified geographical area). For instance, when considering investing in a retail brand, investors look at foot traffic data over a period of time around a series of points of interests (POI). In this case, the foot traffic volume and trends in comparison to other locations and brands help inform their decision to buy, sell or hold a retailer’s stock. If store traffic is up, but share prices are down, fund managers can use it as a reason to increase their holdings, so if the share price goes up they will gain returns.

Through the use of geospatial technology, investors have an advantage for making profitable investments in new ventures. In particular, hedge fund managers employ the tactic of quantitative investing by adding computing power and big data sets to stock-picking skills that test their hypotheses. Instead of only looking at financial statements to predict future profits or the potential to repay a company’s debt, a portfolio manager can test this theory with algorithms that crunch through data from multiple sources.

By understanding the flow of traffic, POI, and consumer behavior, hedge fund managers can ingest insights into existing models to complement traditional data and inform decision-making such as retail development or office optimization strategies. According to a 451 Research report, 45% of financial services firms find it crucial to have location intelligence easily accessible so that they can act on emerging opportunities and market trends.

As the leading independent location intelligence platform, Foursquare empowers hedge funds to make smarter and timely decisions with contextualized data that offer insights on market trends, competitor performance and cross-industry behavior. Not only is geospatial technology beneficial when you’re investing in stocks, but it can also be used in everyday investment decisions – whether that is investing in new product development or in opening a new retail store location.

Act quickly based on real-time fresh data to achieve business objectives

Why is location data so sought out? Agility and real-time data are what sets geospatial technology apart for decision makers to determine their best course of action in a data-driven, nimble and fast manner.

The hedge fund space operates across various industry intelligence insights, like measuring increased activity at oil wells, or changes at supply chain hubs.The quality of this location data is of utmost importance, as it is foundational to inform their trade decisions based on POI, tickers and stable panels.

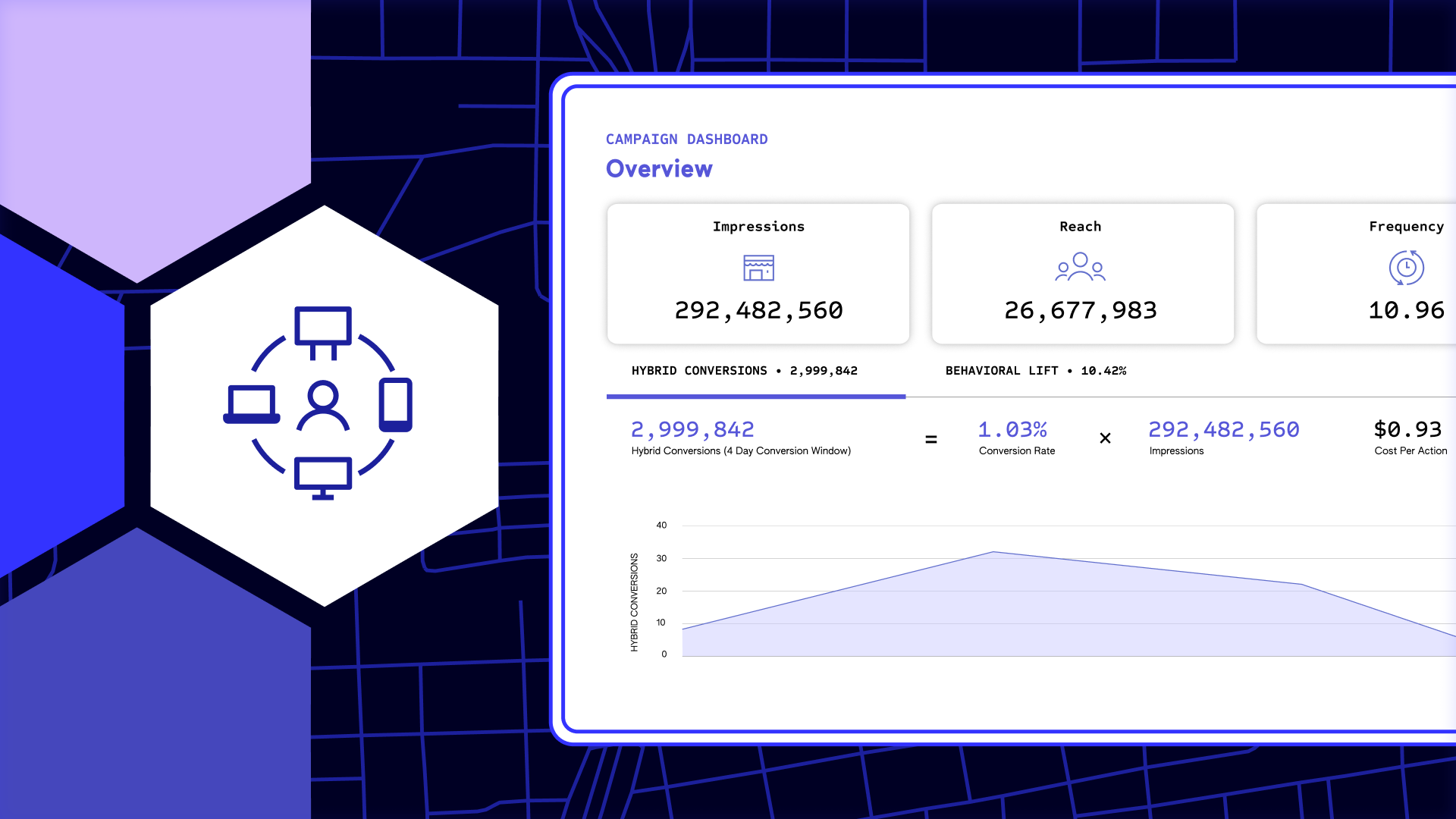

According to a 451 Research report, the top challenge for financial services firms is data quality. This is because the value of data is dependent upon having the highest quality data. The combination of all data points from geospatial technology allow hedge fund managers to create differentiated portfolios, increase stability of market predictions, avoid crowded trades, decrease risk of a short squeeze, create custom economic indicators, and connect the dots between different sources of data.

Moreover, in order to keep track of market leaders in a given location, hedge funds require a statistically relevant number of stable users for commercial visitation measurement, mapping to ticker symbols as well as fresh venue data such as change in operational ownership (e.g. a Starbucks location becomes a Birch Coffee location).

Location data offers insights such as net positive population growth and upwards mobility in terms of average income, which are vital indicators when examining migration patterns and discovering emerging areas. The accuracy that geospatial data provides enables financial services firms to accurately understand human activity. In fact, a 451 Research report found that from the data strategy leaders that currently integrate location intelligence into their models, 76% see increases in ROI/performance.

Advanced data developments lure customers

One of the top potential use cases for businesses when working with location intelligence is customer acquisition, according to 451 Research. Location data offers corporate analysts the ability to uncover various sources of investments and profits, plus the ability to obtain a holistic view of a company’s performance and the overall competitive market. From a customer’s point of view, this complex analysis is highly attractive as data is increasingly becoming an influential part of their investment decision making. Lucrative customers might also perceive this as an advantage by working with a firm that has extensive data insight. This way, customers are able to determine the level of competition they are likely to face within their business, thus gaining an edge, as the more competitive the field is, the more profitable and higher the market it is. Therefore, location intelligence is a win-win implementation for both parties – firms and customers – allowing firms to understand and find new clients for their business, while helping customers make informed data-driven decisions based on the firms’ use of geospatial technology.

Regardless of industry, competitive analysis is the most used strategy to know the landscape and gain an edge over competitors.